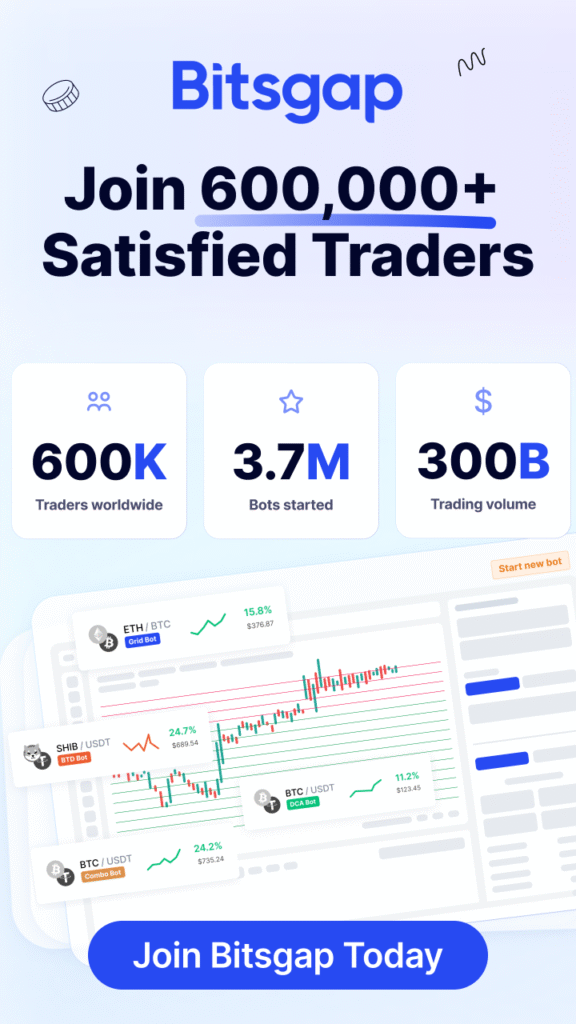

Automated Crypto Trading Strategies Powered by Bitsgap Bots

Discover a smarter way to trade crypto through automated strategies driven by Bitsgap Grid, DCA and Futures bots. Build consistent performance, reduce manual tasks and trade with greater confidence.

Why Traders Use Bitsgap for Automated Crypto Trading

Bitsgap provides a streamlined suite of automated crypto trading tools built to help traders operate more efficiently in every market condition. With intelligent trading bots, smart order execution, and flexible strategy models, Bitsgap reduces manual workload and improves decision-making. Clear, actionable insights make it easier to understand how each automation system works and how consistent, data-driven routines can deliver more reliable trading results.

Core Principles of Bitsgap’s Automated Trading System

Bitsgap’s automation framework integrates strategic trading models, adaptable bot systems, and data-driven execution to provide traders with a reliable and structured approach in shifting market environments.

Automated Execution

Bitsgap’s trading bots execute predefined strategies automatically, reacting to market movements without emotional bias. Continuous monitoring and rule-based action help maintain stability and reduce manual intervention.

Grid & DCA Strategy Frameworks

Grid and DCA mechanisms form a core part of Bitsgap’s automation design, enabling traders to capitalize on volatility, manage positions more efficiently, and build structured long-term trading approaches.

Data-Driven Insights

Bitsgap incorporates advanced metrics, chart analytics, and smart order tools that help traders interpret market conditions, refine entries and exits, and manage overall risk with greater precision.

Bitsgap Trading Bots Explained

Each Bitsgap bot is engineered with a unique logic designed to match different trading styles, volatility levels, and performance goals—giving traders structured, automated strategies backed by proven frameworks.

Objective: Capture frequent profits in sideways markets with Bitsgap’s automated grid strategy.

Execution Logic: The Bitsgap GRID Bot structures a price range into multiple levels and executes buy- and sell-orders automatically as the market fluctuates. This approach enables traders to profit from repeated micro-movements while keeping risk controlled. It is ideal for environments where consistent volatility creates regular trading opportunities.

Objective: Achieve smoother long-term entries using Bitsgap’s automated dollar-cost averaging system.

Execution Logic: The Bitsgap DCA Bot reduces exposure to sudden price swings by splitting investments into smaller, timed entries. This strategy helps traders build positions more safely and improve average cost levels during volatile conditions. It is one of Bitsgap’s most reliable methods for steady accumulation.

Objective: Generate ongoing returns through Bitsgap’s automated asset-switching cycles.

Execution Logic: The Bitsgap LOOP Bot trades between two assets, reinvesting profits automatically with every completed cycle. By compounding gains and maintaining continuous activity, this bot aligns perfectly with moderately trending or stable markets—ideal for traders seeking consistent automated performance.

Objective: Enhance futures trading consistency with Bitsgap’s volatility-aware DCA automation.

Execution Logic: Built for futures markets, the Bitsgap DCA Futures Bot applies averaging techniques to improve timing and stabilize performance during rapid price movements. Its structured risk approach helps traders navigate leveraged markets more confidently and with greater control.

Objective: Combine grid volatility gains with futures trend trading using Bitsgap’s hybrid automation.

Execution Logic: The Bitsgap COMBO Bot merges grid-based micro-trading with futures market mechanics. By targeting both minor fluctuations and broader market swings, it delivers a more aggressive and dynamic strategy tailored for experienced traders aiming for higher potential returns.

Objective: Buy discounted assets automatically with Bitsgap’s Buy The Dip strategy.

Execution Logic: The Bitsgap BTD Bot identifies declining price phases and enters positions at more favorable levels without emotional timing. This automation helps traders secure strong entry points during downward movements and prepare efficiently for long-term recoveries.

How Bitsgap Automation Enhances Your Trading Results

Structured guidance helps traders understand how Bitsgap’s automation tools work across different market phases. Clear, practical insights explain how to fine-tune bot settings, identify profitable conditions, monitor ongoing performance, and integrate automation into long-term trading goals. This section provides actionable knowledge for anyone looking to use Bitsgap’s bots more effectively and confidently.

Bitsgap’s bots offer flexible configuration options that allow traders to align each strategy with current market conditions. Adjusting order spacing, price ranges, investment size, and execution frequency ensures that every Bitsgap bot operates with precision and follows the trader’s intended logic.

Different bots excel in different environments. Grid bots thrive in sideways markets, DCA bots perform well during steady trends, and futures bots benefit from momentum shifts. Recognizing consolidation zones, volatility cycles, and breakout phases helps traders choose the most effective Bitsgap automation setup.

Fine-tuning range widths, safety orders, protective levels, and volatility responses allows traders to improve execution quality. With Bitsgap’s structured automation system, adjustments to spacing, stop-loss levels, or take-profit targets help maintain disciplined trading behavior.

Start Using Bitsgap Trading Bots Today

Bitsgap’s automation suite brings structure, precision, and efficiency to crypto trading. Whether using Grid, DCA, or advanced Futures bots, traders gain powerful tools to navigate volatility and execute consistent, rules-based strategies. Learning how each Bitsgap bot functions is the key to making informed decisions and building more reliable long-term trading outcomes.